How DebtRiot Calculates Your UK Debt Payoff Plan (Methodology)

Short version: DebtRiot turns your debts into a month-by-month plan you can follow. It’s built for the UK (APR/EAR, overdrafts, minimums), runs in your browser (anonymous), and exports a printable PDF with your debt-free date, payoff order, milestones and calendars.

Quick links:

• Compare methods free → Snowball vs Avalanche Calculator

• Get your personalised PDF → Debt Payoff Calculator UK (£14.99)

• See what’s inside → Sample Plan

• FAQs → FAQ

What the planner does

Builds a month-by-month schedule from today to debt-free

Supports Snowball, Avalanche, Hybrid (switch after N) and Custom ordering

Handles UK overdrafts (EAR) and 0% promotional periods

Lets you set your payday, then provides printable calendars

Shows milestones (each debt cleared, debt-free date)

Optional What-If: add a monthly extra to see time & interest saved

Inputs (what you enter) & how the budget is calculated

1) Your monthly numbers (entered once):

Income (take-home, per month)

Essentials (per month): rent/mortgage, bills, food, transport, etc.

Emergency fund (optional, per month)

The planner calculates your debt budget automatically:

Debt budget = Income − Essentials − Emergency fund

2) Your debts (add each one):

Name (e.g., “Barclaycard”)

Balance today (£)

Rate — APR for cards/loans, EAR for overdrafts

Minimum payment (£) — one fixed amount per month

Optional promos: 0% promo months left and revert APR (post-promo rate)

3) Your preferences (entered once):

Strategy: Snowball, Avalanche, Hybrid (switch after N) or Custom

Payday: the day of the month you usually pay towards debts

How the monthly allocation works

Interest modelling (APR vs EAR)

Cards/loans: we use your APR and apply a monthly rate to the remaining balance after that month’s payments.

Overdrafts: UK overdrafts are quoted as EAR. We convert EAR to an equivalent monthly rate for planning.

Fees: add any one-off fees (e.g., balance-transfer fee) to the balance if you want them reflected.

We model months discretely. Daily accrual nuances are approximated by the monthly rate - accurate enough for planning and a clear printable schedule.

Payoff ordering (four methods)

Snowball — smallest balance first

After minimums, leftover budget targets the smallest remaining balance.

Why choose Snowball? Quick wins → easier to stick with.

Avalanche — highest APR/EAR first

After minimums, leftover budget targets the highest interest rate debt.

Why choose Avalanche? Often minimises total interest.

Hybrid — switch after N months

Run one method first, then automatically switch to the other after N months. You choose both the starting method and N (common choices: 3–6 months).

Custom — your order

Choose the exact payoff order (e.g., clear a specific lender first to free a limit).

0% promotional periods (balance transfers & offers)

Default: during a 0% promo, that debt gets minimum payments only. When the promo ends, the revert APR applies and the planner re-prioritises automatically.

Option — prioritise early: tick “Prioritise 0% promo debts early” to clear a promo balance before it ends (e.g., to free credit).

Option — permanent 0%: tick “Include permanent 0% in priority” to treat truly 0% balances like normal debts.

Tip: set promo months left accurately and enter the post-promo APR so dates and interest totals reflect reality.

Overdrafts (EAR) — how we handle them

Add overdrafts using EAR.

Overdrafts are included like other debts; under Avalanche, they’re typically targeted early due to the effective rate.

If fees apply, include them in the balance you enter.

Payment timing, payday & calendars

Choose your payday; the plan assumes one payment per month on/near this day.

The PDF includes calendars. The year view shows your payday note at the bottom

Monthly schedule pages show payment amounts and running balances.

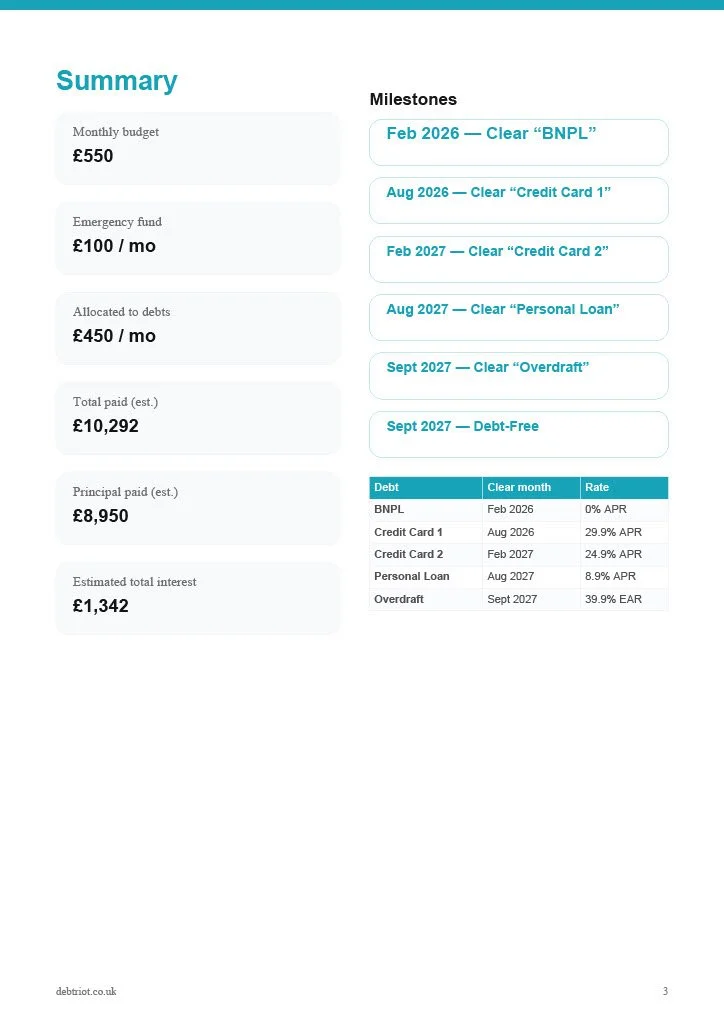

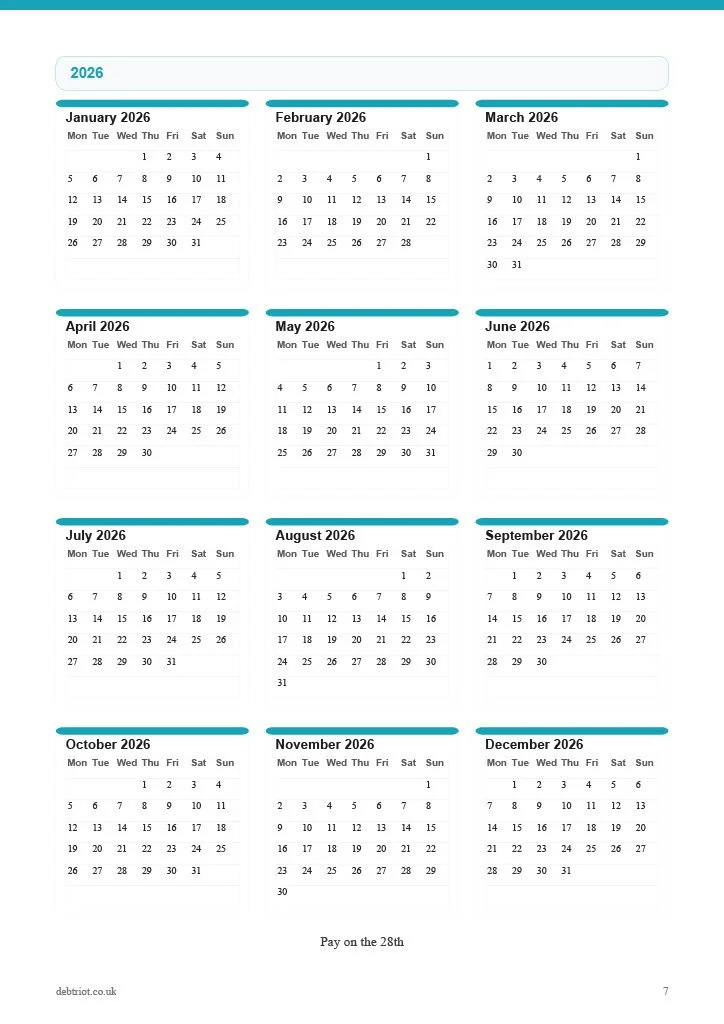

Example pages from a personalised plan (sample numbers): summary with debt-free date and milestones, plus calendar page (year view). Your chosen payday is shown once at the bottom (e.g., “Pay on the 28th”). Running balances appear on the monthly schedule pages.Rounding, micro-balances & edge cases

Payments round to pennies.

When a balance is within a few pounds of clearing, we pay the final residual and re-allocate any small remainder to the next debt that month.

If your budget is below total minimums, the planner flags a shortfall.

Assumptions & limitations

Self-guided planning tool; not regulated financial advice.

You maintain your inputs (balances/rates) to keep results accurate.

Variable/penalty rates and missed-payment fees aren’t predicted.

Interest is modelled monthly; daily compounding effects are approximated.

Privacy & data

Anonymous by design: inputs run in your browser; we don’t save your numbers.

No account required; the PDF is generated from your current inputs.

-

There isn’t one “best” for everyone. Snowball gives quick wins. Avalanche often pays the least interest. Hybrid starts with one, then switches after N months (you choose). Custom lets you set the exact order.

-

By default, promo debts get minimums only while the promo lasts. When it ends, the revert APR applies and the plan re-prioritises automatically. You can optionally prioritise promos early or treat permanent 0% like normal debts.

-

Yes. Enter the EAR; we convert it to an equivalent monthly rate. Overdrafts are treated like other debts; under Avalanche they’re typically targeted early due to the effective rate.

-

You enter income, essentials, and (optionally) an emergency fund. We calculate a debt budget = income − essentials − emergency fund, pay all minimums first, then send the leftover to one target debt per your method.

-

We flag a shortfall. Consider adjusting inputs or contacting StepChange / National Debtline (free, regulated support in the UK).

-

We model monthly interest using your APR/EAR. Daily accrual nuances are approximated - accurate enough for planning and a clear printable schedule.

-

A month-by-month schedule, payoff order & milestones, calendars (year view with payday note, monthly schedules show running balances), and an optional What-If page.

-

Yes, anonymous by design. Inputs run in your browser; no data is saved and no account is required.