Debt Payoff Calculator UK - Personalised PDF Plan (£14.99)

Turn your numbers into a step-by-step plan you can follow. Choose Snowball, Avalanche, Hybrid (switch after N) or Custom, then download a printable PDF with your debt-free date, exact monthly payments and calendars. Anonymous. No sign-up. Instant download.

Not sure which method to choose? Compare methods free first

Anonymous • No account • One-time £14.99 • No financial advice

Instant digital content. If something goes wrong with your file, we’ll replace/repair/refund.

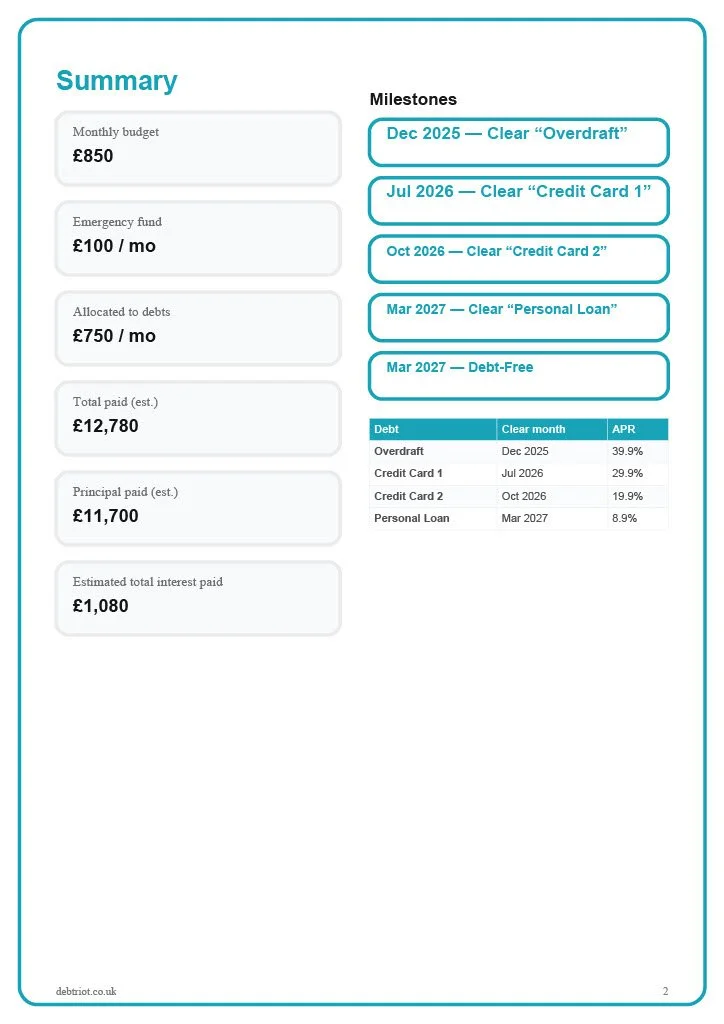

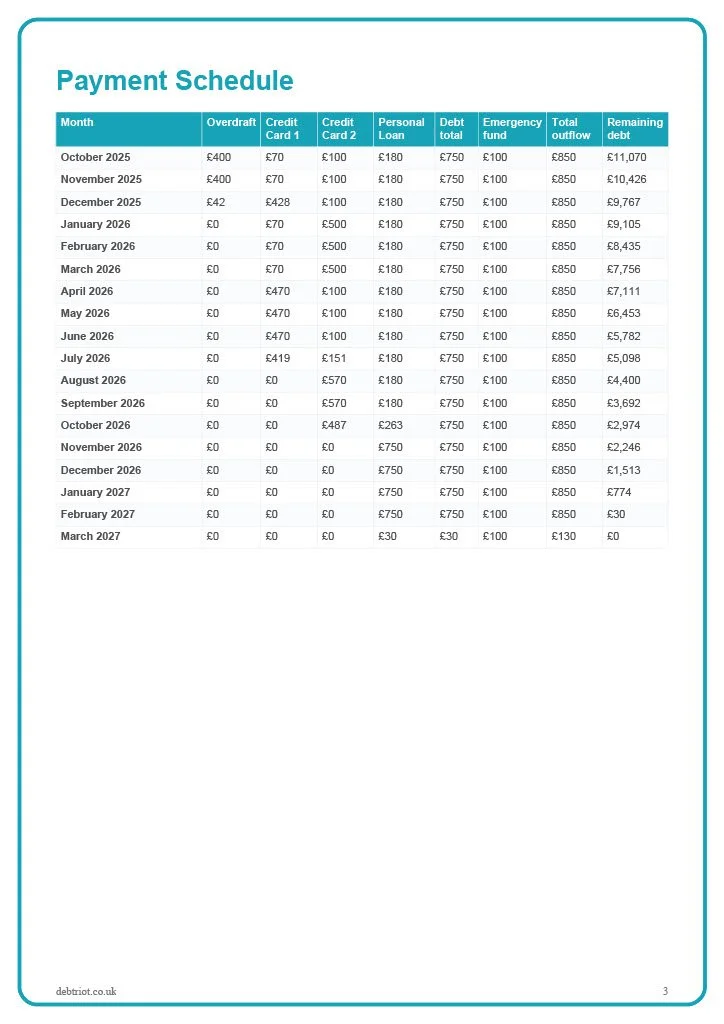

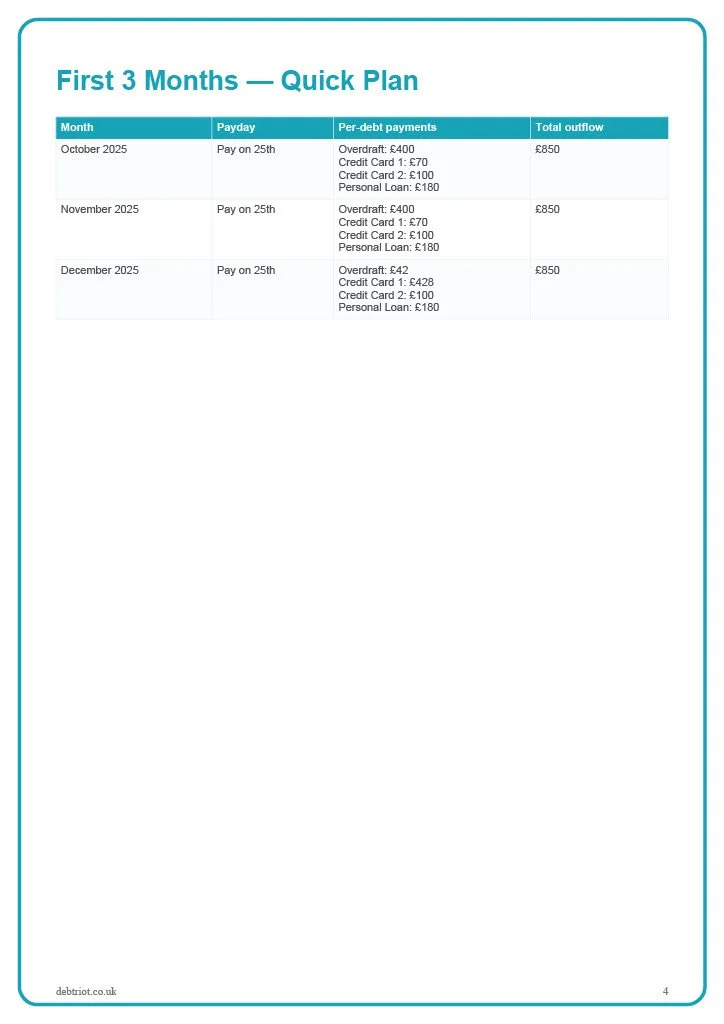

What’s inside your personalised PDF

Exact monthly payments per debt

Payoff order & milestones for Snowball / Avalanche / Hybrid (N) / Custom

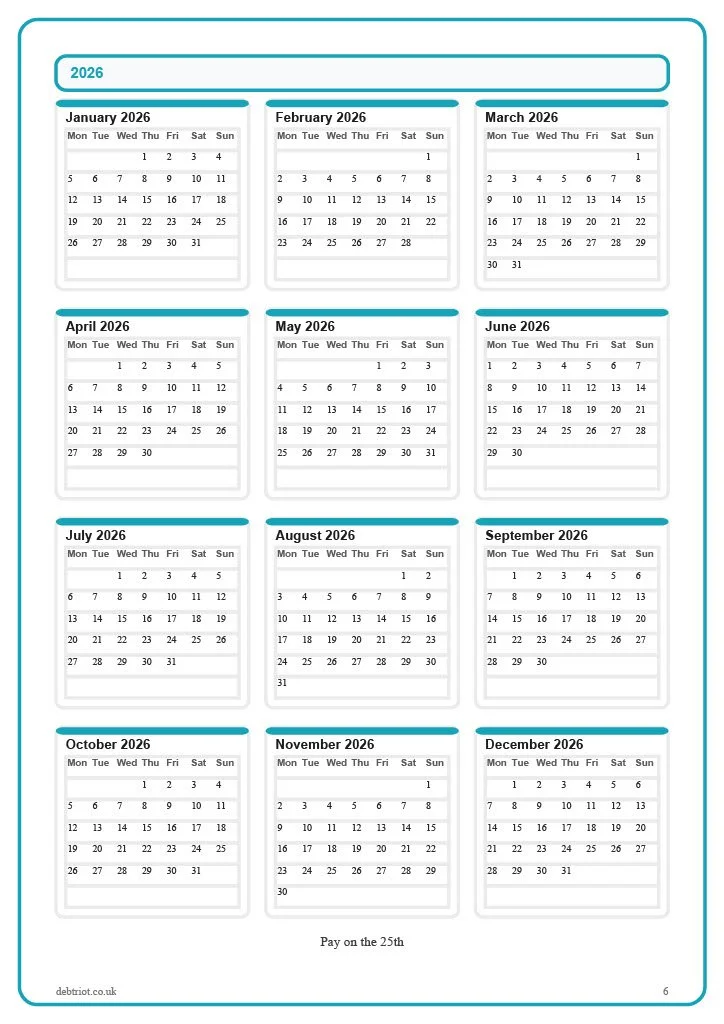

Printable monthly calendars until you’re debt-free (with your chosen payday)

Optional What-If: enter a monthly extra to see time and interest saved

Totals: estimated interest, principal repaid, and debt-free date

Debt Payoff Planner — Create Your DebtRiot Plan

Shown on the cover title. Optional — leave blank if you prefer.

Used for headings and accents in your PDF.

Your total take-home pay per month.

We calculate your debt budget automatically: Income − Costs − Emergency fund.

Set aside this amount before debt payments.

Adds a What-If page showing time & interest saved if you add this extra monthly.

Debts

One row per debt. Type: choose APR for credit cards/loans or EAR for overdrafts. Promo fields are APR-based.

| Debt name | Balance (£) | APR/EAR % | Type | Min payment (£) | Promo APR % | Promo months |

|---|

Limit: up to 20 debts.

Payoff strategy

When off (recommended), promo 0% debts are generally paid after higher-cost debts.

When off (recommended), permanent 0% debts only get minimums until all interest-bearing debts are cleared.

Used in calendars and reminders in your PDF.

How it works

-

Enter income and essential costs (or the amount you can pay toward debt). Optionally set an emergency fund that comes out before debt payments.

-

Add each debt’s name, balance, APR and minimum. We’ll validate that your monthly budget covers at least the sum of minimums.

-

Pick Snowball, Avalanche, Hybrid (switch after N) or Custom payoff order. Choose your monthly payday. Optionally enter a What-If extra per month to see how much sooner you’ll be debt-free and how much interest you’ll save.

-

Click Generate PDF Plan. After secure Stripe checkout (£14.99), you’ll be redirected to our thank-you page to generate your PDF immediately.

One-time £14.99. Instant download. Not financial advice.

Why DebtRiot

Built for the UK, fully anonymous, and a one-time £14.99 plan you can actually stick to.

UK-specific (APR, overdrafts, minimums)

Anonymous: inputs processed in your browser

One-time price: £14.99 (no subscription)

Clear, printable roadmap you can stick to

Important information

-

Enter the promo APR and months left. The plan prioritises that debt during the promo, then switches to the standard APR automatically.

-

Yes. Add it like any other debt with its current APR.

-

They’re different to commercial debts. Many people prioritise higher-APR debts first and pay student loans as scheduled. Choose the order you can stick to.

-

A month-by-month schedule, payoff order, milestones, a “Quick plan” for the first 3 months, printable calendars, and an optional What-If page.

-

Yes. Inputs run in your browser; we don’t save your numbers. No account.

Need more? See the full FAQ

DebtRiot is a self-guided planning tool - not financial advice. If you can’t meet essentials or repayments, consider free, regulated help such as StepChange or National Debtline.