Best Debt Payoff Calculator UK: For People Who Have Money But No Plan

The best UK debt payoff calculator handles EAR (overdrafts) and APR (credit cards) correctly, compares multiple strategies side-by-side, and shows your exact debt-free date. Most calculators are American and give UK users wrong results. DebtRiot is built specifically for UK debts — free preview available, full plan £9.99.

You're not broke.

Money comes in every month. You pay rent, bills, food. There's even £150-300 left over.

But somehow the debt never shrinks.

You split that spare money between four different debts. £50 here, £75 there. Feels responsible. But six months later, every balance looks almost the same.

You know there must be a smarter way. Pay one debt aggressively while minimums on others? But which one first? The biggest? The smallest? The highest interest?

You've Googled it. You've found American advice that doesn't quite fit UK overdrafts. You've seen bank calculators that mysteriously lead to "consolidation loan" offers.

What you actually need is simple: a way to see all your options, compare them, and pick one.

That's what this page is about.

The Problem Nobody Talks About

If you can't pay your bills: Charities like StepChange and National Debtline help. They negotiate with creditors, set up payment plans, guide you through formal solutions. They're brilliant — and free.

If you want a loan: Banks are delighted to help. Consolidation loans, balance transfers, "simplify your payments" — they'll crunch your numbers all day.

But if you're in the middle?

You earn decent money. You can cover minimums. You have spare cash each month. You just don't know how to attack the debt strategically.

Charities can't help here — they're regulated to give impartial advice, which means they can't say "pay this one first because of the interest rate." That's a recommendation. They're not allowed.

Banks won't help — you're not looking to borrow more.

And American calculators? They treat your 39.9% EAR overdraft the same as a 39.9% APR credit card. Those compound differently. The payment order they suggest might be wrong for UK debts.

You fall into a gap: too stable for crisis help, too savvy for loan sales pitches, but stuck without a strategic tool.

What "Best" Actually Means for UK Debt

A debt payoff calculator needs to do three things well:

1. Handle UK Interest Rates Correctly

UK overdrafts use EAR (Equivalent Annual Rate). Credit cards use APR (Annual Percentage Rate).

These aren't the same thing:

39.9% EAR = 2.84% monthly

39.9% APR = 3.33% monthly

A calculator that treats them identically will tell you to pay debts in the wrong order — potentially costing you hundreds of pounds.

2. Compare Multiple Strategies

"Pay highest interest first" isn't the only option. There are five common approaches:

| Strategy | Pays First | Best For |

|---|---|---|

| Avalanche | Highest interest rate | Saving most money overall |

| Snowball | Smallest balance | Quick wins, motivation |

| Avalanche→Snowball | High rates, then small balances | Savings first, wins later |

| Snowball→Avalanche | Small balances, then high rates | Early wins, then efficiency |

| Cash Flow Index | Lowest balance÷payment ratio | Freeing up cash quickly |

A calculator that only shows one or two strategies isn't giving you the full picture.

3. Show You The Numbers — Not Tell You What To Do

This is important: a calculator is a tool, not an advisor.

It shows you: "Avalanche saves £287 but takes 9 months for first win. Snowball costs more but you clear a debt in 3 months."

You decide what matters more to you. The tool just makes the options visible.

DebtRiot: Built for the Gap

DebtRiot exists because I was in that gap myself.

I had a decent job. I could pay my bills. I had money left over. But I also had debts — all collecting interest, none shrinking fast enough.

I didn't need a charity. I didn't want a loan. I wanted to see my options and make a choice.

So I built a tool that does exactly that.

What DebtRiot Shows You

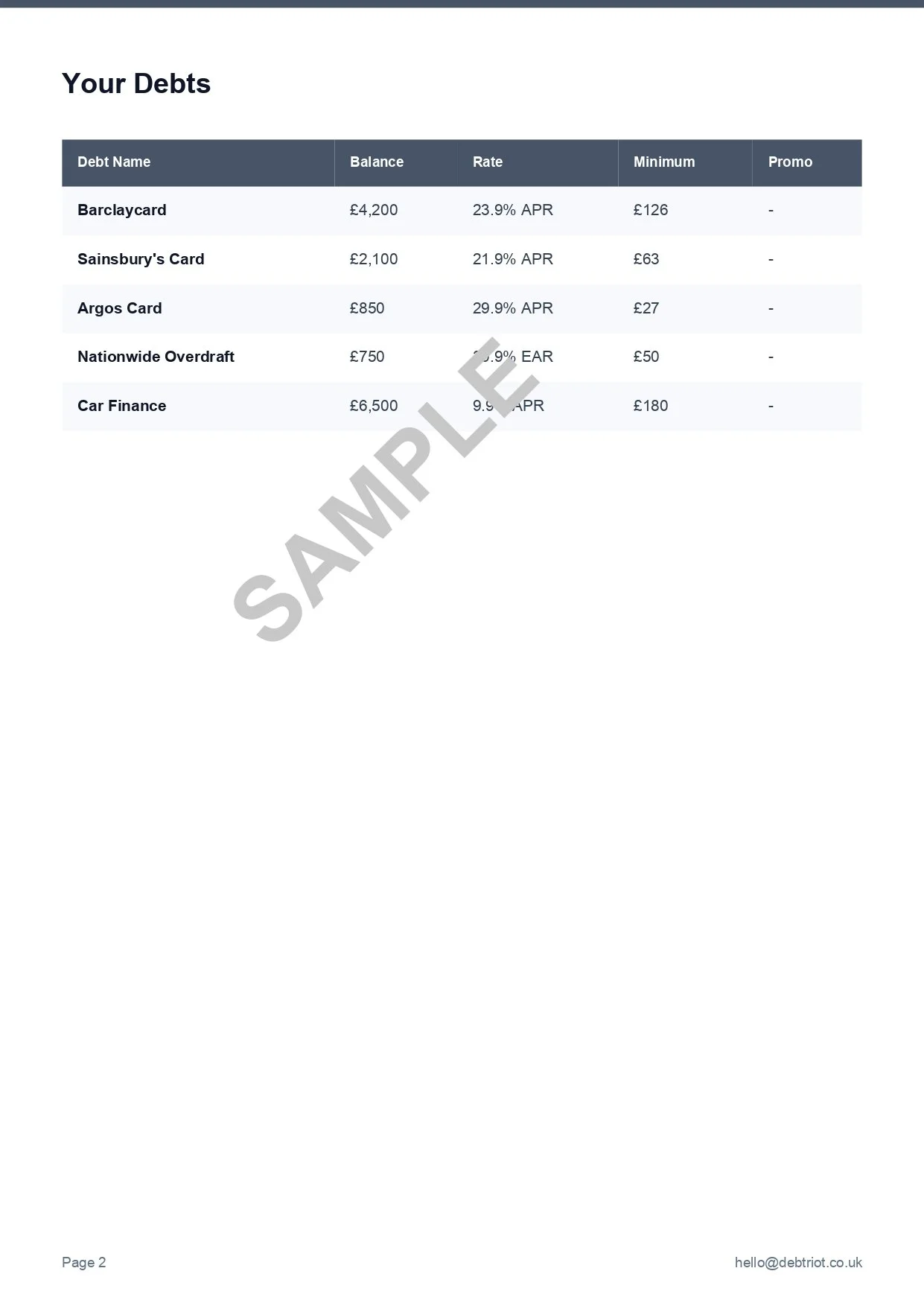

Enter your debts:

Balance

Interest rate (you select APR or EAR — the calculator handles the maths)

Minimum payment

Set your monthly budget:

Total amount you can put toward debt

Must cover all minimums plus whatever extra you have

See all 5 strategies compared:

| What You See | Why It Matters |

|---|---|

| Debt-free date for each strategy | Know exactly when you're done |

| Total interest for each strategy | See what each approach actually costs |

| First debt cleared (and when) | Know when you'll get your first win |

| Order of payments | See which debt gets attacked first in each strategy |

The comparison shows real trade-offs:

Maybe Avalanche saves £340 but your first win is 11 months away. Snowball costs more but clears a debt in month 3. A hybrid splits the difference.

You see the numbers. You choose what fits your psychology.

Free Preview vs Full Plan

DebtRiot isn't free. But the preview is.

Free Preview (No Signup)

Enter your debts

Compare all 5 strategies side-by-side

See debt-free date for each approach

See total interest for each approach

View your first 3 months of payment plan

Re-run as many times as you want

What you get: Enough to understand your situation and choose a strategy.

Full Plan — £9.99 One-Time

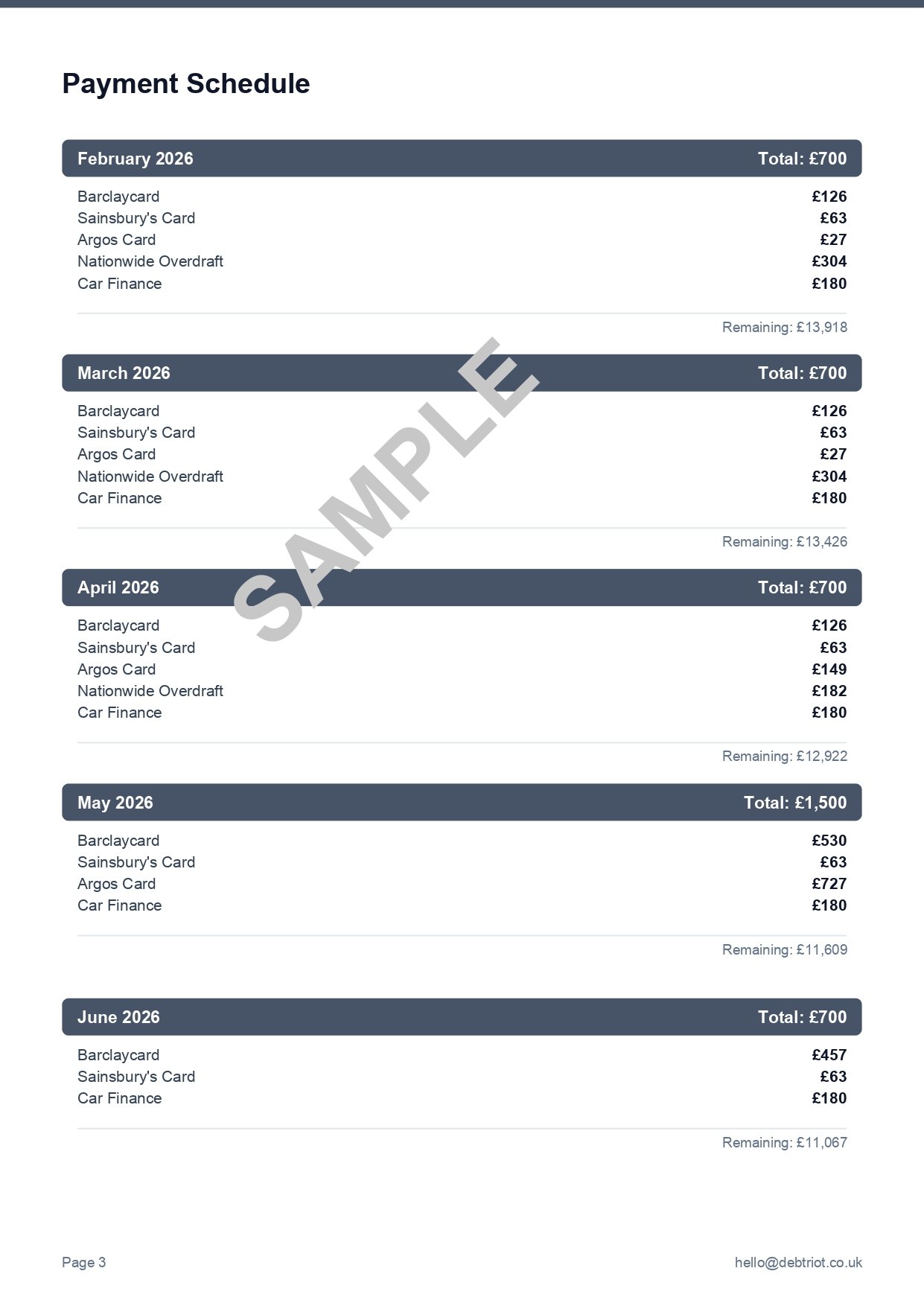

Complete month-by-month payment schedule

Exact amount to pay each debt, each month

Running balance showing progress

Calendar view with milestones

"What-if" scenarios (extra payments)

Printable PDF to track progress

What you get: A complete roadmap from today to debt-free.

What The Full Plan Looks Like

Printable PDF

Everything above in a clean document. Print it, stick it on your fridge, tick off months as you go.

How To Use DebtRiot

Step 1: Enter Your Budget

Add your monthly income, essential costs, and how much you want to set aside for emergencies.

Takes 2 minutes.

Step 2: Add Your Debts

Enter each debt with its balance, interest rate (APR or EAR), and minimum payment.

Add promo rates and one-off payments if you have them.

Step 3: Compare Strategies

DebtRiot calculates 5 proven payoff strategies and shows you which one saves the most money and time.

See your debt-free date, total interest, and milestones.

Step 4: Get Your PDF Plan

Download a professional PDF with your full payment schedule, monthly calendar, milestones, and what-if scenarios.

One payment, unlimited updates forever.

Steps 1-3: Free — no signup required, preview first 3 months Step 4: £9.99 — one payment, unlimited updates

Who DebtRiot Is For

This tool is for you if:

You have income after essential expenses

You can cover minimum payments on all debts

You want to pay off debt faster but don't know the best approach

You'd rather figure it out yourself than talk to someone

You want UK-correct calculations, not American approximations

This tool is NOT for you if:

You can't afford minimum payments

Creditors are taking legal action

You need someone to negotiate on your behalf

You're in crisis and need support

If that's your situation, these services are free and genuinely helpful:

They exist to help people in difficulty. No shame in calling.

Try It Now

No signup. No email. Enter your debts, compare 5 strategies, see your debt-free date.

Free preview shows first 3 months. Full plan is £9.99 if you want it.

Your data stays in your browser. Close the tab and it's gone.

Frequently Asked Questions

-

The best UK calculator handles EAR (overdrafts) and APR (credit cards) with different calculations, compares multiple strategies, and shows exact debt-free dates. Most calculators are American and give wrong results for UK debts.

-

The preview is free: compare all 5 strategies, see debt-free dates, view first 3 months. The complete payment plan is £9.99 one-time — not a subscription.

-

A calculator shows you what happens with each approach. "Avalanche saves £287. Snowball clears a debt in month 3." You see the trade-offs and decide. It's a tool that shows options, not an advisor that gives recommendations.

-

UK overdrafts use EAR (already includes compounding). Credit cards use APR (compounding calculated separately). A 39.9% EAR overdraft costs differently than a 39.9% APR credit card. Calculators that ignore this give you the wrong payment order.

-

Then a calculator isn't what you need right now. Contact free charities — they're non-judgmental, and can negotiate with creditors on your behalf.